By Mmeeme Leticia and Leonard Kamugisha Akida,

PARROTS UG|TECHNOLOGY REPORT:

A new report by the communications regulator, Uganda Communication Commission – UCC indicates that there is a modest growth in communication sector in the country.

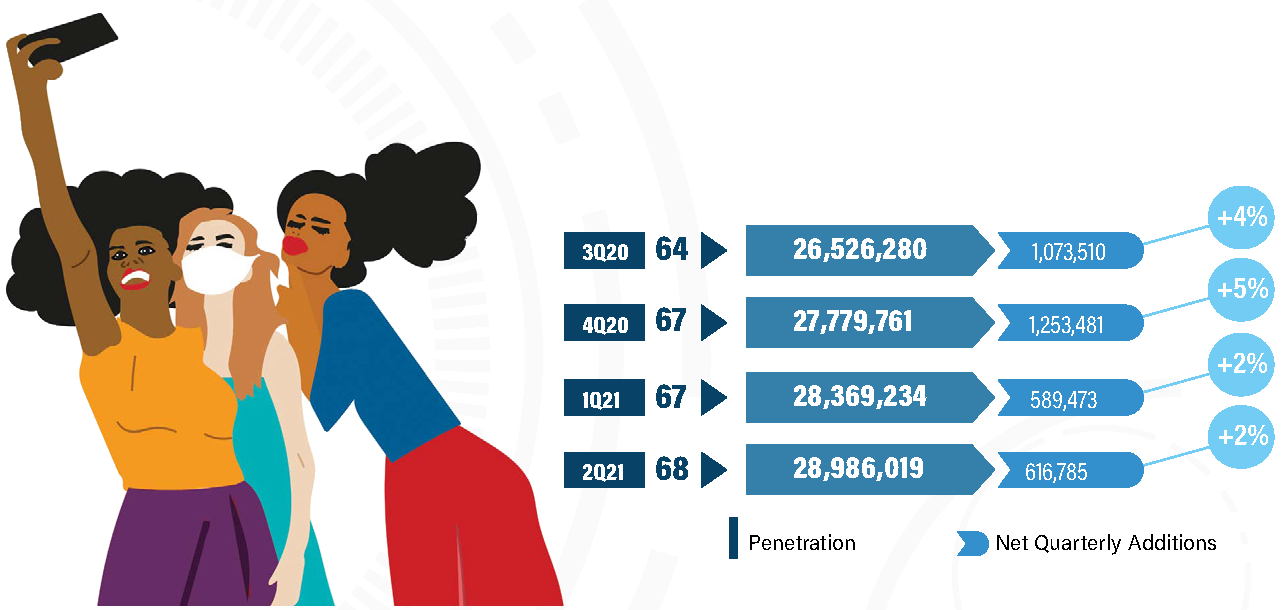

According to a report that was released on September 14, 2021, telephone and internet subscriptions grew by same percentage between the months of April and June,2021.

“Telephone and internet subscriptions grew by the same percentage between April and June 2021, as the communications sector registered modest growth across all major indicators, the latest market performance report indicates.” read excerpts of the report.

29M people subscribe to mobile telephone while 22M users are on the internet, NEW findings indicate.

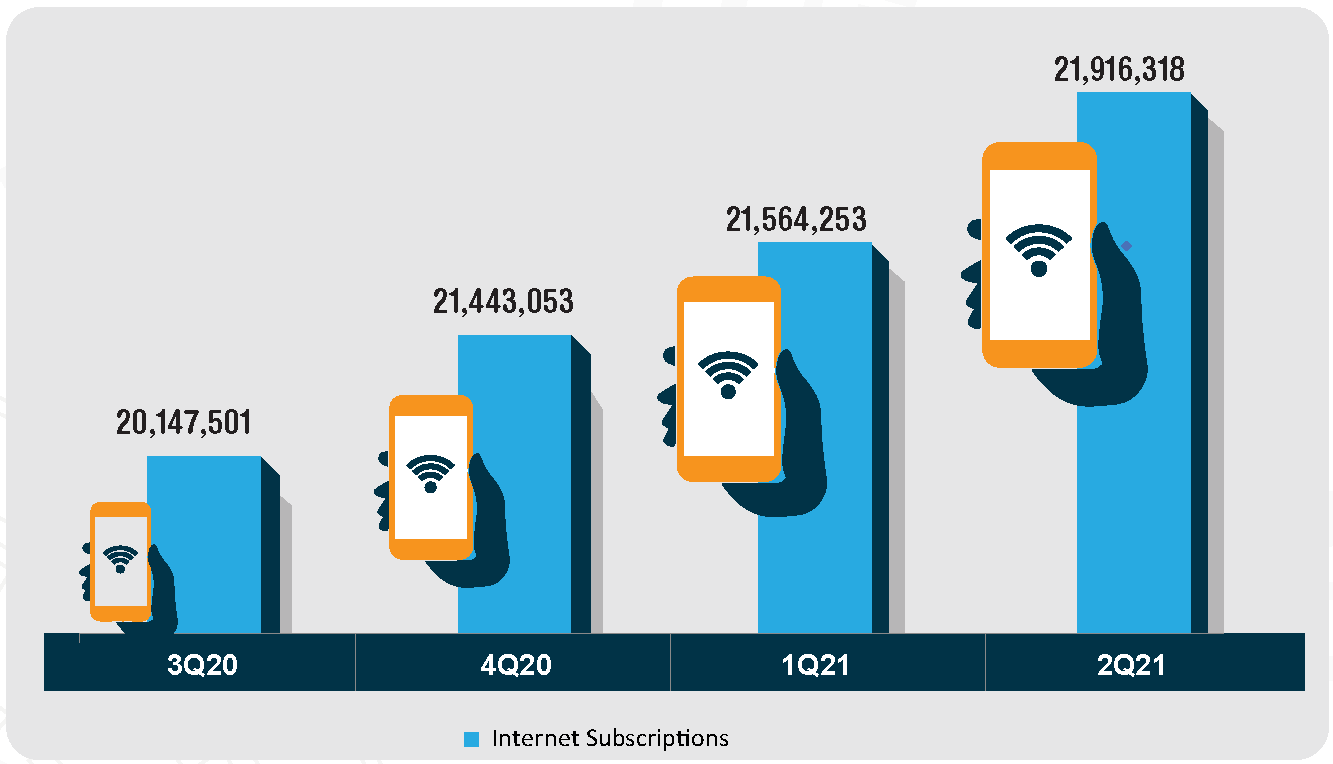

“Fixed and mobile telephone subscriptions grew by 600,000 from 28.3 million to 28.9 million, a growth rate of 2%, while internet subscriptions grew by 352,000 from 21.5 million to 21.9 million, also equivalent to 2% growth,”

UCC says that the growth in telephone subscriptions has pushed Uganda’s teledensity to 68%, up from 67% in March, according to commission’s quarterly industry report.

Teledensity refers to the number of phone connections available per 100 people within a given geographical area.

National telephone penetration stands at 7 lines for every 10 Ugandans. A recent study report by the Uganda Bureau of Statistics (UBOS) data showed that more than 60% of the population is less than 18 years old.

By extension, the nearly 29 million active subscriptions translate into a penetration of almost 2 lines for each of the 16.8 million adults in Uganda (above 18 years).

UCC recorded 3 million new broadband subscriptions between June 2020 and June 2021, translating into a 16% year-on-year growth.

The nearly 22 million broadband subscriptions translate into a broadband penetration of 1 internet connection for every 2 persons. By extension, that is equivalent to an active connection for every 1 of the 17 million adults aged above 18 in Uganda.

“It should be noted, however, that the new work-from-home and online study arrangements, especially in the urban centres, may mean that a few homes account for multiple data SIMs, skewing the general internet penetration landscape,” the report pointed out.

The growth in internet penetration mirrors related growth in total MBs downloaded, which jumped by 19% from 58.3 million at the end of March to 69.3 million at the end of June 2021.

Also keeping pace was the number of smart devices connected to the network. During the quarter under review, 900,000 new gadgets were added to the public communication networks, a 3% growth that brought the total devices on the networks to 32 million.

More than 30% of the new terminals were internet-enabled gadgets, while 70% were basic and feature phones. According to the report, by the end of June 2021, the total number of connected smartphones or internet-enabled gadgets stood at 9.7 million, while feature phones and basic phones were 22.4 million.

“The less than 10 million smartphones on the market implies that more than half of the mobile broadband connections can only support basic browsing applications,” the report stated. “This presents a big gap in harnessing the true potential of mobile broadband connectivity.”

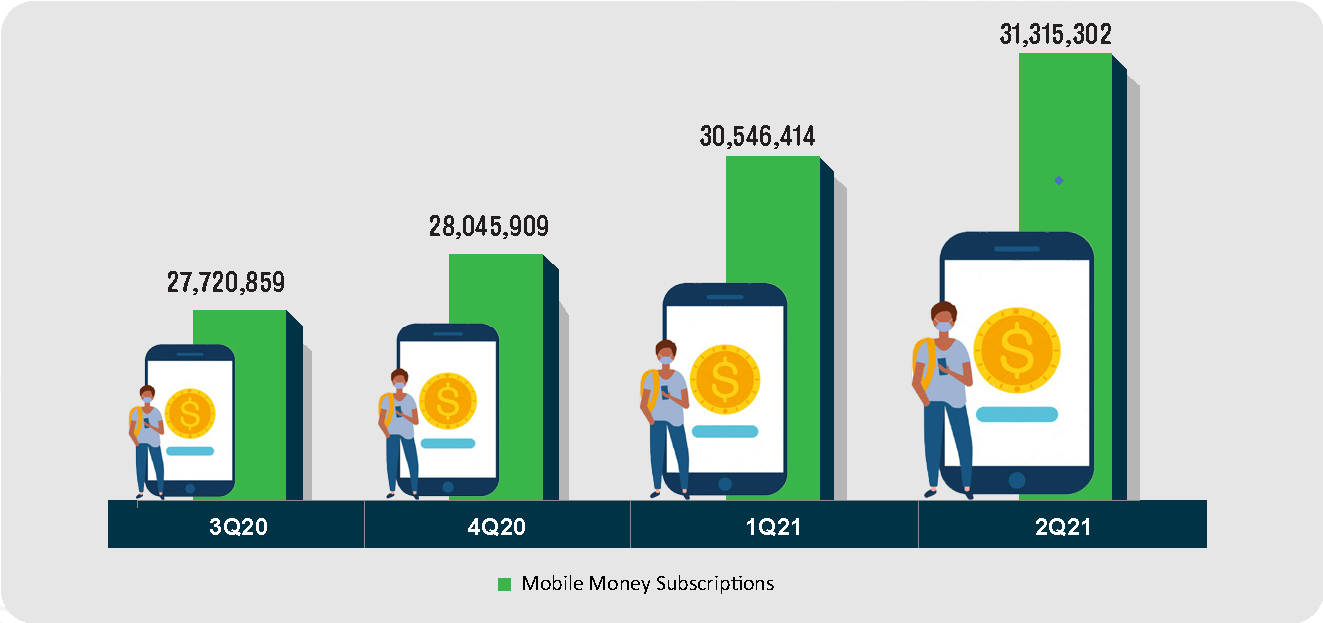

There was also modest growth in the mobile financial services segment, with subscriptions rising by 2% to 31.3 million at the end of June, up from 30.5 million at the end of March 2021. This reflects a net addition of almost 800,000 newly registered mobile money accounts in the three months leading up to June 2021.

On the other hand, active mobile money subscriptions grew by 4%, from 20.2 million to 21.1 million during the quarter under review, while the number of mobile money access points grew by 30,000 new accounts during the same period.

In addition, mobile money agents also grew by 12%, from 254,930 to 284,976, partly fueled by increased onboarding of mobile money services by previously stand-alone bank agents.

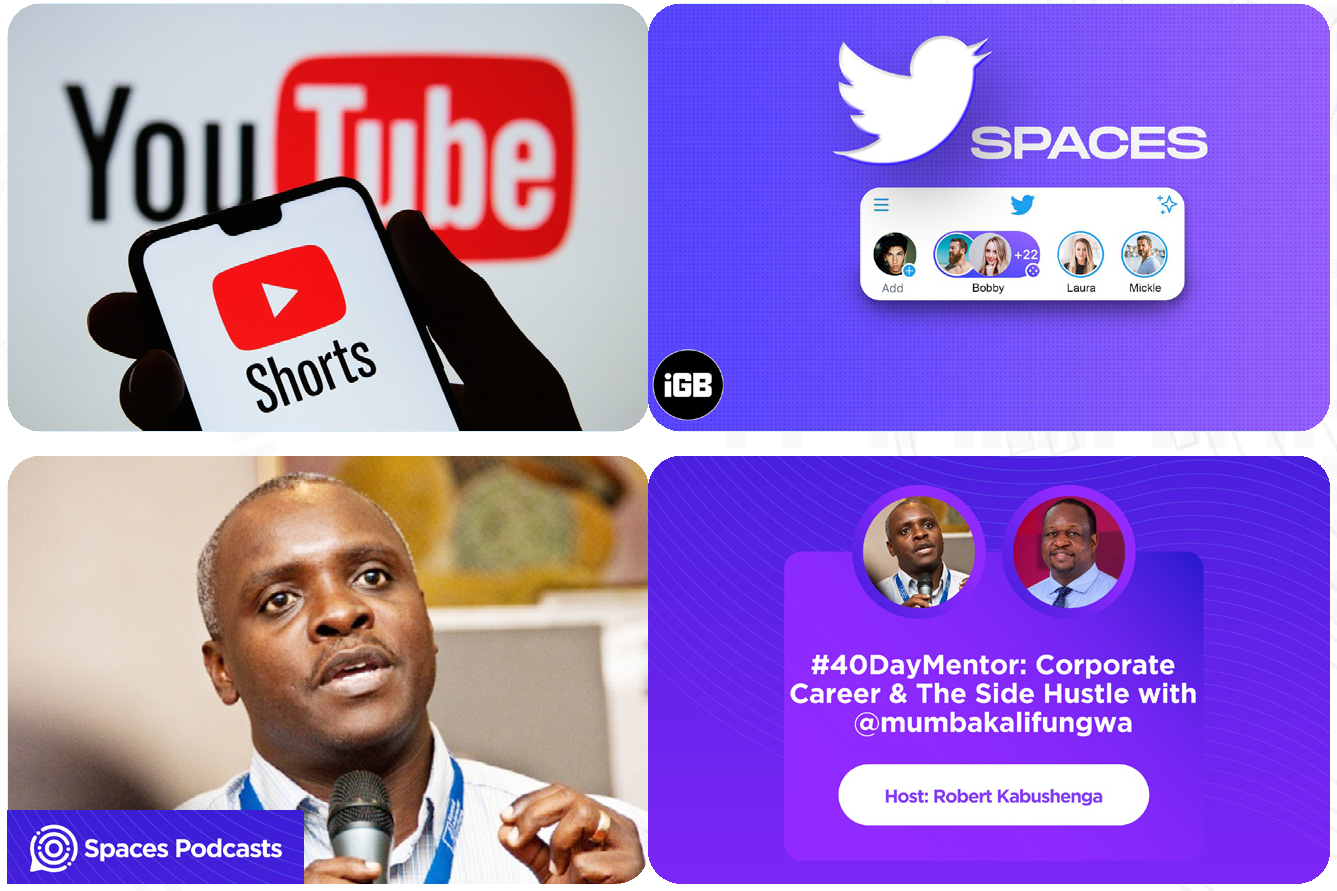

On the global scene, the social media space continued to set the pace for digital innovation, with video and audio chat platforms such as Twitter Spaces and YouTube Shorts now all the rage.

In Uganda, Twitter Spaces has been championed by, among others, Mr Robert Kabushenga through his #40DayMentor initiative during the 42-day lockdown. At one point, the #40DayMentor audience on Twitter Spaces peaked at more than 1,000 participants a session.

At the regional level, Ethiopia concluded its search for the first non-state-owned telecommunications operator in the country after a protracted process ended with the Safaricom-led consortium getting the coveted license in May 2021. The consortium includes Kenya’s Safaricom, Vodacom, Vodafone, UK’s CDC Group and Japan’s Sumitomo Corporation.

Over and above the $850 million license fees, the consortium pledged to invest more than $8 billion in the Ethiopian telecoms market over the next 10 years.

Back home, the quarter under review also saw COVID-19 fueled innovations in the local tech ecosystem, with an aggressive growth of remote e-health platforms.

“E-health services have grown from the basic over the phone doctor consultations to include services like counselling, remote diagnosis, lab sample collection, home tests, and prescription delivery, among others,” the report says.

By the end of June, more than 10 local insurers (including UAP, Jubilee Insurance and IAA) had started extending health insurance cover through various e-health start-ups.

In addition, several health facilities had entered joint ventures with e-health start-ups such as Rocket Health, Venro Health and Go GP to provide e-health services.

The quarter also witnessed policy stewardship changes at the national level, with Dr Chris Baryomunsi coming in as new Minister of ICT & National Guidance. He was joined by ministers of state Hon. Joyce Ssebugwawo and Hon. Godfrey Kabbyanga to complete the new-look political leadership of the ministry. The trio replaced Hon. Judith Nabakooba and Hon. Peter Ogwang who were transferred to other dockets.

The ministry also got a new Permanent Secretary in Dr Aminah Zawedde, with Mr Vincent Waiswa Bagiire moving to the Ministry of Foreign Affairs in the same capacity.

As the Financial Year 2020/21 came to an end, the Government introduced a host of tax amendments affecting the sector, including doing away with the Local Excise Duty on Over-the-Top Services (OTT), the introduction of a new Excise tax on data services, and the revision of VAT on telecom Value Added Services.

SOURCE: UCC blog.