By Leonard Kamugisha Akida,

KAMPALA

A civil society organisation has warned the Government against what it termed irresponsible borrowing, saying the country’s rising public debt and increasing reliance on domestic financing pose serious risks to the economy.

Uganda’s public debt rose to Shs116.21 trillion by June 2025, up from Shs94.72 trillion in June 2024, according to official figures.

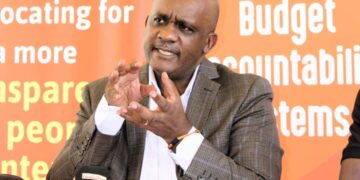

The executive director of the Civil Society Budget Advocacy Group (CSBAG), Julius Mukunda, said the sharp increase was largely driven by large-scale infrastructure investments and mounting fiscal pressures ahead of the 2026 general elections.

Addressing journalists at the organisation’s offices in Ntinda on Monday, Mukunda was presenting CSBAG’s views on the National Budget Framework Paper (NBFP) for the 2026/2027 financial year.

“The Government has increasingly turned to domestic borrowing to finance fiscal deficits. This has altered the composition of the debt portfolio and raised concerns about sustainability,” Mukunda said.

He urged authorities to be more deliberate about why and where they borrow from in order to protect Ugandans from future economic strain.

He added that domestic borrowing, while sometimes necessary, can crowd out private sector credit and push up interest rates, thereby slowing economic growth.

Mukunda also challenged the Government to explain the impact of election-related spending on the economy, noting that election financing has contributed to fiscal pressure.

Government allocated about Shs1.23 trillion for electoral activities, with about 72% of the funds utilised by the Electoral Commission, according to CSBAG.

The organisation called for stronger fiscal discipline, improved transparency in public borrowing, and a clearer strategy to manage debt levels as the country approaches the 2026 elections.