LUWERO

dfcu Bank in partnership with Vision Group, KLM, Embassy of Netherlands in Uganda, and Koudjis has today launched the 11th edition of the Best Farmers Competition at Prime Agro Farm in Zirobwe, Luweero District under the theme Value Addition with Focus on Large Scale Farmers and Cooperatives.

The competition was officially unveiled during an event at Prime Agro Farm Ltd., located in Zirobwe. The farm is owned by Sebastian Ruta Ngabwa, the winner of the 2023 edition of the Best Farmers Competition.

Over the years, the competition has significantly contributed to increased agricultural production on farms countrywide. This year, the focus shifts towards value addition, with an emphasis on enhancing the quality and marketability of farm outputs.

All the winners from the various sub-regions will be required to showcase how they add value to their products, demonstrating innovations in processing, packaging, or branding. Through this approach, the competition aims to promote proper post-harvest handling practices and ensure that farmers maximize returns from their produce.

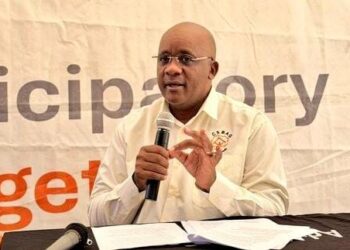

Speaking during the launch, Mathias Jumba, Head of Integrated Channels at dfcu, said, The Best Farmers Competition celebrates Uganda’s most impactful farmers, and in doing so, inspires many more to turn agriculture from mere survival to sustainable prosperity. For over 60 years, dfcu has been a steadfast partner to Uganda’s farmers and agribusinesses. Our focus was, and remains: to bridge the financing gap, support value chains, and uplift both large-scale agribusinesses and small holder farmers across all regions of this country, he said.

He added, “Through innovations such as agricultural loans and asset financing, the bank has provided not only capital but also a strong foundation for growth and expansion to thousands of farmers. As a result, farmers now have better access to markets, infrastructure, and expertise, enabling them to scale their operations and achieve their dreams.

Alex Madolo, Sector Head, Agriculture at dfcu Bank noted, We are privileged to witness the transformation of farmers’ lives and livelihoods through access to finance and training. At dfcu Bank, we see ourselves not just as a financial services provider, but as a committed partner in the growth and success of businesses across Uganda.”

He also applauded the sponsoring partners of the initiative, who have been a part of its 11-year journey. “Vision Group, the Embassy of the Netherlands, KLM, Koudijs have remained committed to this vision of Transforming the lives of agriculture practitioners, their families, communities and businesses.

For 2025, new competition categories including, Large-Scale Farmers, Small and Medium-Scale Farmers and Farmer Cooperatives have been added to the initiative.

Through its agricultural sector support arm, the dfcu Foundation, dfcu Bank has made significant contributions to the development of the agricultural sector in Uganda. Strides in transforming Uganda’s agribusiness.

As of December 31st, 2024, the Centre recorded remarkable achievements in empowering agribusiness enterprises and farmers across the country.

Key achievements include:

• Support to 1,281 agribusiness enterprises through a combination of debt financing and capacity-building programs aimed at enhancing productivity and operational efficiency.

• Acceleration support for 490 enterprises, enabling them to scale and sustain growth through tailored mentorship and business development interventions.

• A 52% women inclusion rate achieved since 2018, underscoring the Foundations commitment to promoting gender equality and empowering women in agribusiness. • A total outreach of 59,000 beneficiaries, demonstrating a far-reaching impact on the sector through training, advisory services, and financial inclusion.

• A total outreach of 59,000 beneficiaries, demonstrating a far-reaching impact on the sector through training, advisory services, and financial inclusion.

• Facilitation of over $22 million in business linkages, fostering stronger market access, trade opportunities, and commercial partnerships.

• Connection of over 5,000 enterprises to financial services, including access to credit and banking solutions, helping drive growth and resilience among agribusinesses.

About dfcu

About dfcu

dfcu was established in 1964 as a development finance institution. Over the years dfcu has been associated with many success stories in Uganda’s economy in various sectors including agribusiness, communication, education, health, manufacturing, tourism, real estate, mining, construction, transport, trade and commerce, among others.

Key Milestones

1964: dfcu Limited established by the Government of Uganda and the CDC

1999: Bought Uganda Leasing Company, renamed it dfcu Leasing.

2000: Bought Global Trust Bank, renamed it dfcu Bank, and started commercial banking.

2004: dfcu Limited was listed on the Uganda Securities Exchange.

2008: Merged its two businesses (Development Finance and dfcu Bank) to create a one-stop shop under dfcu Bank.

2007: Launched dfcu Women In Business

2013: Realignment of shareholders bringing on board a strategic partner Rabobank, with significant experience in

agribusiness

2014: Consolidated business operations into our Head Office – dfcu Towers.

2014: dfcu Bank acquired some assets and took over some liabilities of Global Trust Bank (In Liquidation)

2015: Launched the Women In Business Advisory Centre

2016: Aligned shareholding with Rabobank, Norfund and FMO combining to form Arise which is committed to strengthening and developing effective, inclusive financial systems in Africa with a long-term perspective.

For more information visit: www.dfcugroup.com