BUSNINESS

Tax compliance remains a cornerstone of national development, providing the government with resources to fund critical services and infrastructure. However, deliberate non-compliance through tax fraud, evasion, or facilitation of such offenses undermines this effort. Uganda’s legal framework—specifically Section 69 of the Tax Procedures Code Act, Cap 343—targets not only primary offenders but also those who aid or abet the commission of tax offenses.

What Does Section 69 state?

Section 69 of the Tax Procedures Code Act criminalizes the act of aiding, abetting, inciting, counseling, or procuring another person to commit a tax offense. The law applies equally to individuals and professionals such as accountants, tax agents, or company staff who knowingly facilitate tax evasion schemes.

The section reads in part:

“A person who aids, abets, counsels or induces another person to commit an offence under this Act commits an offence and is liable, on conviction, to a penalty similar to that imposed for the principal offence.”

This provision broadens accountability by ensuring that facilitators those who enable or conceal the offense face the same legal consequences as the principal offender.

URA’s Enforcement of Section 69: Recent Trends and Action

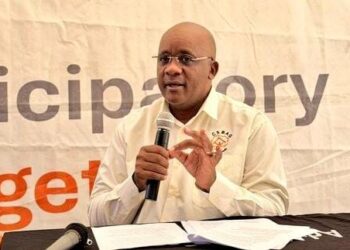

According to Mr. Denis Kugonza Kateeba – URA Commissioner of Tax Investigations, the Uganda Revenue Authority (URA) has significantly ramped up its enforcement of Section 69 in recent years, leveraging data analytics, whistleblower tips, and forensic audits to detect tax offenses involving accomplices. Through its Tax Investigations Department (TID), URA has uncovered cases where company employees, particularly accountants and tax agents, have deliberately manipulated financial records to understate tax obligations.

Key Enforcement Actions Include:

Targeted Investigations: URA has conducted surprise audits and seizure operations at company premises to collect both soft and hard copy evidence of tax manipulation.

Prosecutions and Arrests: Several individuals have been prosecuted for aiding and abetting offenses, including accountants who prepared false VAT returns or advised clients on how to conceal income.

Professional Accountability: URA collaborates with professional bodies such as ICPAU (Institute of Certified Public Accountants of Uganda) to hold errant accountants accountable. Disciplinary actions, including suspension and de-registration, are being pursued where evidence of unethical conduct exists.

Key Lessons for Taxpayers and Accountants

1. Accountants Have a Legal Duty Beyond Compliance: Accountants are not mere record-keepers; they are custodians of ethical financial reporting. Ignorance or blind compliance with unlawful instructions from company directors does not absolve one from liability under Section 69.

2. Documentation and Transparency Are Crucial: Maintaining accurate and verifiable records is critical. Any discrepancies between tax returns and actual business records can trigger suspicion and investigations.

3. Intentional Misreporting Is a Criminal Offense: Taxpayers who deliberately instruct their staff or consultants to conceal or misrepresent financial data are liable for criminal prosecution, along with any accomplices.

4. Professional Advice Must Be Law-Abiding: Tax consultants and accountants must ensure that their advice aligns with the law. Recommending schemes that minimize taxes through deception or omission can amount to aiding a tax offense.

5. Whistleblowing Is Protected and Encouraged: URA encourages whistleblowers to report tax crimes, including complicity by professionals. Protections are in place to ensure confidentiality and, in some cases, reward for whistleblowers.

Conclusion

The enforcement of Section 69 of the Tax Procedures Code Act serves as a stern reminder that tax compliance is a shared responsibility. As URA intensifies its enforcement mechanisms, taxpayers, accountants, and other professionals must uphold the highest standards of integrity and transparency. Aiding or abetting a tax offense is not only unethical—it is criminal. Staying on the right side of the law not only protects businesses from penalties and reputational damage but also contributes to national development.