By Leonard Kamugisha Akida,

NATIONAL:

The Uganda Revenue Authority (URA) has issued a regulation requiring individuals that are transacting land in Uganda valued at Shilling 10 million and above to have the autjority’s Tax Identification Number (TIN) for tax payments.

“This is to bring to your attention that effective 6 December, both the purchasers and sellers of Land transacting at Ugx 10 million and above are required to have Tax Identification Numbers (TINs)” URA ordered.

According to a Memorandum dated December 3 that was seen by Parrots UG, URA says this has been done to broaden the tax base in the country.

“This is aimed at registering potential tax payers and widening the current tax base,” the memo read in part.

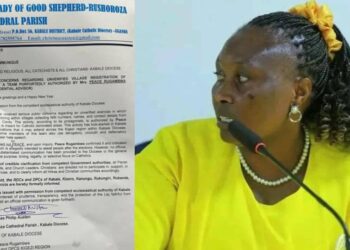

Milly Isingoma Nalikwago, the assistant commissioner of research at URA has said that a public notice of the requirement for TIN’s has been circulated both in print and display. She appeals to all TIN verification and approving authorities to handle the applications within the service level agreement.

URA has further urged to officers handling stamp duty transactions to follow the guidelines and to ensure that all parties in the land transfer have TINs.

The directive begins with effect from December 6.