KAMPALA

Stanbic Bank Uganda, in collaboration with the Uganda Bankers Association (UBA), on Monday convened a targeted engagement with online media personalities, digital editors, prominent content creators and social-media influencers to deepen national fraud-awareness efforts at a time when Ugandans increasingly consume news online.

Opening the session, Candy Wekesa Okoboi, Stanbic Bank’s Head of Legal, emphasised the banking sector’s duty to partner with credible digital voices as fraud schemes evolve: “With more Ugandans—especially women, youth and farmers—depending on online sources for financial information, strengthening public awareness through trusted digital creators is essential. Fraudsters thrive on misinformation. We must work together to ensure customers receive clear, accurate guidance.”

She added that online platforms have become central to consumer protection, particularly during the festive season and the heightened activity of the political campaign period, when fraud attempts tend to spike.

Sophia Nakazibwe, Stanbic’s Head of Fraud Risk Management, underscored the importance of proactive education: “Customer awareness remains our first line of defence. Fraud tactics are becoming more sophisticated, but well-informed customers are far less likely to fall victim. Engaging online media helps us meet people where they already are.”

Ronald Mugisha, a cyber-risk specialist at the Uganda Bankers Association, highlighted industry-wide alignment in tackling fraud: “This is not a challenge that any bank can solve alone. The entire industry is collaborating to strengthen public resilience, and online creators are crucial partners because they shape how Uganda receives and interprets information today.”

Adding a media-development perspective, Flora Aduk from the African Centre for Media Excellence (ACME) welcomed the shift toward engaging digital communicators: “Online influencers have become important intermediaries in public information. When they are empowered with accurate context and responsible reporting practices, their impact on public safety is significant.”

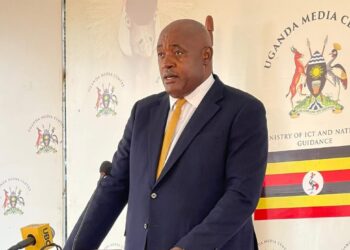

Stanbic Bank’s Country Manager for Corporate Communications, Kenneth Agutamba, who also chairs the UBA Committee on Marketing and Communication, reinforced the industry’s unified stance: “This engagement reflects our collective obligation to safeguard the financial ecosystem. All UBA member banks are collaborating to ensure consistent, credible messaging that counters fraud at scale—and digital creators play an indispensable role in that effort.”

Participants from the digital-media community lauded the initiative, with one content creator observing that, “Banks engaging us directly shows they understand the realities of today’s media. Fraud awareness needs to be communicated in formats people actually consume—short, clear, digital-first content.”

The initiative is part of broader ongoing efforts by Stanbic Bank and the UBA to advance public financial safety, promote responsible online reporting, and strengthen collaborative approaches across Uganda’s increasingly digital information landscape.

Anderson Katongole, a content creator, said, “Many times, several people go out to use influencers, but they do not train them. They do not give them adequate information on what they are going to do and why they should do it, and how. That is why a lot of this information ends up being mixed with the dance challenges that are often fun but not informative at that stage. We thank Stanbic Bank for this initiative.”