KAMPALA

Equity Bank Uganda is once again facing criticism after a customer accused the bank of withdrawing a substantial portion of her savings without her consent.

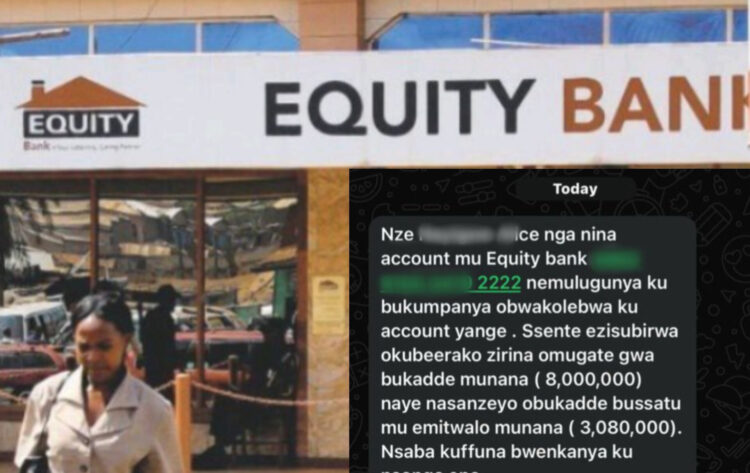

In a social media post seen by Parrots Media, the frustrated client reported that she had saved UGX 8 million in her account, but upon checking her balance, she was shocked to find only UGX 3.8 million remaining. The woman has demanded justice from the bank, expressing her disbelief and frustration.

The bank allegedly explained that the funds were used for online shopping, an explanation the customer vehemently denies. She insists that her ATM card has been securely kept and never used by anyone else.

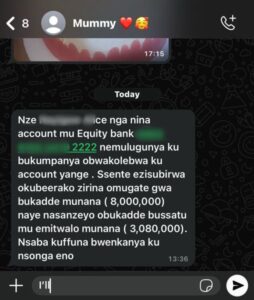

Shortly after the incident, a social media user, claiming to be the client’s daughter, took to platform X (formerly Twitter) to voice her dissatisfaction with the situation.

“My mum’s money disappeared from @UgEquityBank. They told her someone used the money for online shopping. Ever since she got her ATM card, she kept it safe. She is sure no one has ever used it,” tweeted @Nkesha3.

The daughter has since called for an immediate investigation into the unauthorized transactions on her mother’s account, as well as similar cases affecting other customers.

“An investigation needs to be done about this @BOU_Official @PoliceUg,” she demanded.

This is not the first time Equity Bank Uganda has been accused of mishandling customers’ funds. In February 2023, Rose Ahebwa, another client, reported that her savings were fraudulently accessed. Ahebwa noticed a discrepancy when a bank teller informed her that her account balance was UGX 27,000, rather than the UGX 45 million she had deposited just months earlier.

“The bank’s customer service had contacted me to encourage me to subscribe to various products, including mobile banking, but I declined,” Ahebwa recalled.

“A few hours later, I discovered via the teller that my account had been drained to just UGX 27,000.”

Ahebwa reported the incident to the branch manager, who assured her the issue would be handled internally. However, the matter was later reported to the police.

Despite these repeated allegations, many affected customers claim that the bank continues to engage in a game of “hide-and-seek” rather than addressing the issues head-on. Growing frustration among Ugandan internet users, especially on X, has led to online campaigns demanding transparency and accountability.

Prominent Ugandan journalist and social influencer Gabriel Buule responded to the latest incident, offering his support.

“Hey @Nkesha3, I’m volunteering to lead the campaign to force @UgEquityBank to refund your mum’s money. If they refuse, I will lead a massive campaign to get 10,000 Ugandans—including myself—to close their accounts.”

As the controversy surrounding Equity Bank deepens, calls for a formal investigation from the Bank of Uganda and law enforcement agencies have intensified.