By Charles katabalwa,

KAMPALA

The government has finalized plans to onboard Microfinance Institutions (MFIs) and Savings and Credit Cooperatives (SACCOs) to improve women’s access to funds under the Generating Growth Opportunities for Women (GROW) Project.

This was announced by the Minister of Gender, Labor, and Social Development, Betty Amongi during a media briefing at Media Centre Kampala on Thursday.

Amongi said the initiative aims to ensure that women, especially those in underserved areas, can access financial support with ease. She highlighted that the project is designed to provide loans to women entrepreneurs, with incentives for timely repayment.

According to the finalized plan, women who meet their loan repayment schedules will receive a grant equivalent to 5% of their loan halfway through the repayment period. Additionally, refugee women and those in host communities will benefit from an 8% grant, while women entrepreneurs from ethnic minorities and regions like Karamoja, Busoga, and Bukedi—areas identified by the Uganda National Bureau of Statistics (UBOS) for their higher poverty levels—will receive a 10% grant as a reward for good performance.

Minister Amongi also shared that the project will be supported by Women Entrepreneurs Platforms (WEPs), which will provide business networking and mentorship. The government has partnered with the Uganda Women Entrepreneurship Association Limited (UWEAL) to strengthen these platforms in 105 districts, with plans to expand coverage to all districts by November 2024.

“Through these platforms,all eligible women entrepreneurs will be mobilized

and supported to receive all GROW services” Amongi says .

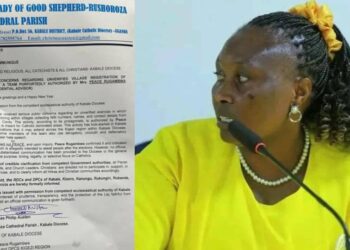

The Minister also emphasized the importance of inclusivity, stating, “All banks partnering with GROW must consider all women irrespective of their status, ensuring that every woman benefits to improve her socio-economic standing.”

She noted that all GROW services, including loans and training, are provided free of charge, and urged the public to report any cases of individuals demanding fees for these

services.

Meanwhile, Dr. Ruth Aisha Biyinzika Kasolo, GROW Project Coordinator, revealed that 96% of the first batch of loans had been successfully disbursed. She assured the public that the government is working to simplify the loan acquisition process, with plans to allow women to access funds without collateral, relying instead on group recommendations.

Aisha denied allegations that women access funds on high rates ,10 times than the real money they ask for development.

The GROW Loan project was launched by Her Excellency Maj (Rtd) Jessica Alupo the Vice President of the Republic of Uganda on 28th August 2024, with focus on raising awareness and mobilizing women in rural, hard to reach areas and underserved regions to access financial services.