By Ambrose Gahene,

KAMPALA

Uganda Development Bank Ltd (UDB) on Tuesday announced the expansion of their net loans to 1.47 trillion. This was during the release of their annual performance report, 2023, at the Ministry of Finance and Economic Development in Kampala.

According to a statement released by UDB, their net loans expanded to UGX1.47 trillion in 2023, reflecting robust support to the private sector. The Bank strengthened its commitment to providing affordable and patient capital, achieving significant milestones amidst economic challenges.The results released reflect a sustained effort to facilitate economic recovery.

During the release, the bank highlighted its continued pivotal role in fostering economic resilience and sustainable growth across key sectors of the economy.

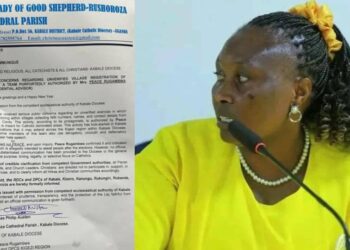

UDB Managing Director, Patricia Ojangole revealed that in the year 2023, the Bank approved UGX691.8 trillion and disbursed UGX610 trillion, demonstrating a dedicated approach to supporting private business growth.

“UDB remains committed to fostering inclusive economic growth through strategic investments in sectors that drive sustainable development and job creation across Uganda. Our focus on key priority sectors underpins our mission to deliver high socio-economic value and support Uganda’s long-term development goals,” she said.

In 2023, the Bank approved funding of UGX692 trillion in new loans to over 200 enterprises in 63 districts nationwide.

“These projects, upon full implementation, are expected to create 18,558 new jobs and generate an output value of UGX11.4 trillion, from which UGX616 trillion will be generated as tax revenue to the Government, and UGX3.34 trillion in foreign exchange earnings,” the Bank’s Annual Report reads in part.

Additionally, the Bank implemented various institutional initiatives to expand its support to various vital sectors and address systemic growth constraints in the economy, including the following; Access to Clean Water:, through a multi-stakeholder partnership, where the Bank extended UGX27 trillion in funding to enhance water supply and improve water infrastructure, especially in scarcity-prone areas; under the program, up to 774 Kms in new water mains extension was realized, 27,307 new water connections realized, and 1,619 new public standpipes constructed to cater for 858 villages across the country.

Regarding Access to Electricity, UDB through a multi-stakeholder partnership, UGX8.1 trillion was deployed through the Hybrid Electricity Customer Connection Credit Framework, facilitating 38,833 new connections to the electricity grid nationwide.

As for Supporting Local Content, the Bank launched a UGX150 trillion funding allocation to support Ugandan contractors participating in infrastructure projects, a testament to the UDB belief in the potential of local businesses.

Concerning Serving the underserved segments, UDB under its Special Programs proposition, the Bank continued to focus on expanding its support to the Youth, Women, and SME segments – with an additional allocation (approval) of UGX21.2 trillion in 2023 and disbursement of an additional UGX13 trillion to support various enterprises across the country, demonstrating UDB commitment to inclusivity and equality.

In addition,UDB enhanced business resilience and formalization,through its Business Accelerator for Successful Entrepreneurship (BASE), where the Bank provided business development and coaching programs to 450 enterprises nationwide, of which 291 were identified to undergo business incubation in 2024.

The program also supported 24 farmer groups,consisting of 444 households and 330 women-led en