However, the fdc party is displeased with the rapid accumulation of loans by the government which according to them is caused by lack of proper accountability & transparency putting a debt burden on Ugandans.

By Leonard Kamugisha AKIDA.

akida@parrotsug.com

The Forum for Democratic Change (FDC) party have expressed total dissatisfactions on Uganda’s accumulating debts in the COVID-19 pandemic.

The party’s claim follow moments after International Monetary Fund (IMF) offered to uganda an Emergency relief loan worth $491.5million in what is termed as “Rapid Credit Facility.”

According to government the IMF loan is an interest free loan meant to deal with the aftermath of Covid-19 economic shock.

However, the fdc party is displeased with the rapid accumulation of loans by the government which according to them is caused by lack of proper accountability & transparency putting a debt burden on Ugandans.

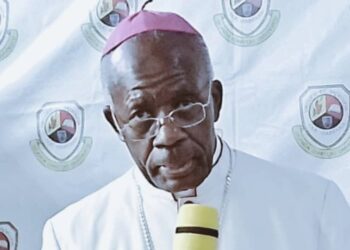

Patrick Oboth Amuriat, the fdc party president, while briefing the press today said there’s no any known strategic plans on how the current IMF loan is going to be utilized.

“IMF has been part of Uganda’s economic problem for decades. They seem not to care how the money borrowed from them is used.” President Amuriat said.

It is not very clear how the current loan is going to be utilized.

“There is scanty information showing that only USD 151m will go to direct stimulation of the economy and most of the loan to the tune of USD 340m to Bank of Uganda to stabilise the exchange rate which we believe puts our priorities upside down.”

FDC therefore, tasked IMF to tell Ugandans how the money is to be used and under what safe guard conditionality’s, under what transparency and anti- corruption measures.

Additionally, FDC suggested three measures for the IMF leadership to put in place in ensuring the loan is well utilized as well as helping Ugandans to see the loan as an odious debt: The measures includes;

- IMF transparency. Publish all information related to the program as soon as possible or allow easy accessibility.

- Government accountability. Government should publish all public contracts involving this IMF loan.

- Parliament should carry out forensic audits on all Covid-19 funds.

Today, Uganda’s national debt stands at Ugx 51.6 trillion putting each Ugandan at a per capita debt of $354.

This according to the fdc and economic experts put the country’s economy at a risk of depreciation.

IMF emergence relief loan is not the only loan Uganda has apparently acquired.

During the press briefing, President Amuriat also expressed worries that part of the loans may be indirectly used in funding the forthcoming Presidential General Elections.

“These loans come barely 7 months away from the 2021 general elections. Given Mr. Museveni’s track record, it is most likely that part of the loans will be salted away for his Presidential electioneering.”